How Can We Help You Today?

Whether you’re looking for sales, service, or parts, Mercedes-Benz Vancouver is ready to meet your needs. Our team of experts will guide you through the ownership process from start to finish, answering any questions you may have along the way. Our commitment to our customers has been recognized widely.

Discover what sets us apart by exploring our product and service offerings online or by visiting us today.

Finding your next vehicle is just a few clicks away.

|

|

Define your budget |

|

|

Create an account |

|

|

Apply for financing |

|

|

Visit us to complete your transaction |

|

|

Choose to trade-in or sell your vehicle |

|

|

Receive an online appraisal in under 60 seconds |

|

|

Obtain top value |

The team at Mercedes-Benz Vancouver is dedicated to building lasting relationships with our customers by offering outstanding products and services. Throughout the ownership journey, we aim to deliver excellence and complete customer satisfaction.

As a Dilawri franchised dealership, Mercedes-Benz Vancouver aims to deliver exceptional customer experiences throughout the ownership journey. Whether you are in the market for a new or pre-owned vehicle, we are committed to helping you to find the model, style, and configuration you want. Our staff will ensure you are kept updated about our exclusive services and exclusive special offers, ensuring you have the information you need to make informed decisions every step of the way.

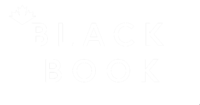

At Mercedes-Benz Vancouver, our goal is to be your trusted dealership. Visit our luxurious showroom to explore our wide selection of electric vehicles, sedans, SUVs, coupes, hatchbacks, wagons, roadsters, and convertibles. Whether you’re seeking out a compact urban explorer like the A-Class or GLA, expanding your horizons with seating for up to seven in the GLS, or hoping to take on new terrain in the iconic G-Wagon, we are ready to assist. If your passion is fuelled by performance, we also have an extensive range of Mercedes-AMG products to offer.

Explore our extensive inventory of new and pre-owned vehicles and discover your next favourite drive at Mercedes-Benz Vancouver today.